Financial planning for Partners of Law and Accountancy Firms during the economic downturn

Investing Views & insightsDespite an easing of lockdown restrictions, the challenges for partners are likely to continue for some time.

8 July 2020 | 3 minute read

The Partnership conundrum

Despite an easing of lockdown restrictions, the challenges for partners are likely to continue for some time.

Across Ireland, members of partnerships are undertaking damage-limiting activity to help ensure their firms’ longterm viability. We are aware of the many difficult decisions partnerships are having to make, including instances of furlough, reductions in paid hours and salaries, deferred or cancelled profit distributions and bonuses, and in some cases, postponed promotions.

For equity partners, the firm’s profit distributions can often be their principal source of income, having accepted these in lieu of a regular monthly salary. Consequently, many partners find themselves faced with the difficult task of exercising responsibility for their staff and colleagues, as well as looking after the wellbeing of their own families and loved ones.

How we can help you

During this unprecedented time, our Wealth Managers are available to help advise partners on how best to navigate their financial options. If you are a partner this provides food for thought:

Replacement Income

In a period of reduced earnings, you may consider accessing investments to top up any shortfall in income. This introduces three important questions for you:

- From which of my investments should I withdraw my funds?

- Is now a good time to be withdrawing funds from the market?

- What are the implications for my long-term planning and how do I address them when life gets back to normal?

Where to draw my funds from?

Not all your savings will be accessible and some will be more liquid than others. Cash, investment portfolios and investment bonds will typically be accessible but with potential tax implications, whereas pension funds can typically only be accessed from age 60 onwards.

The tax implications of drawing from each source should also be considered. Drawing from your cash savings will not incur tax. Drawing from an investment portfolio, investment bond or your pension will likely incur either an Exit Tax or Capital Gains Tax liability depending on exactly what is withdrawn, though there are solutions that could minimise any tax payable.

If you can draw from a pension, you could inadvertently limit future savings into your pension, so care needs to be taken.

Is now a good time to withdraw from my savings?

From a holistic perspective, livelihoods, health and wellbeing are the most important factors. It is imperative to explore if your belt can be tightened or if there is scope to delay withdrawal. Markets are down approximately 13% (at the point of writing) from where they were before Covid-19 set in and a number of partnerships are looking at cash saving measures. This means that leaving invested assets untouched will help with their recovery.

If you do need to top up your income and do not have cash savings to fall back on, then drawing on existing funds is probably the best option and we can help you understand in what order and from which funds you should draw from.

What are the implications for my long-term planning and how do I address them when life gets back to normal?

Unless you are accessing emergency cash savings designed for a moment such as this, you will be drawing from assets designed to provide for your future.

This is possibly the most important point. If you do need to draw down, what does it do to your long-term plans? It could mean working to a later age, it could mean accepting a lower level of income when you’ve finished work, or it could mean making a higher level of savings in future so that other compromises are not required.

A comprehensive financial plan will allow you to understand the long-term implications of a short-term action.

There is no single solution because everyone has different circumstances, and discussing these with one of our Wealth Managers will help you to make the correct decisions.

Pension Contributions

As a partner you will have the option to make pension contributions each year to either a PRSA or a personal pension, or you may have access to a scheme provided by your employer.

A self-directed pension is an excellent alternative for those who want more control over the investment of their pension fund. Brewin Dolphin can act as your investment manager, and facilitate the setting up of a self directed pension with Zurich Life or act as investment manager for your pension assets via your existing employer’s scheme.

Key benefits of a self-directed pension include:

- Greater control over the investments within your pension fund

- Bespoke investment strategy tailored to your specific pension and investment needs

- A one-to-one relationship with a Brewin Dolphin investment manager

- Transparent charging structure

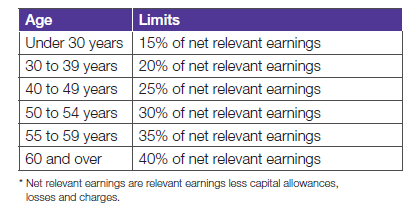

Full income tax relief at your marginal tax rate is available on personal contributions. Contributions are based on your age, and your net relevant earnings. The maximum net relevant earnings* that can be used for pension funding purposes is €115,000 pa.

Brewin Dolphin can provide advice on the wide range of pre-retirement pension options, and is a Qualifying Fund Manager and can provide advice on post retirement options such as Approved Retirement Funds.

We specialise in reviewing existing plans and policies that you may have invested in previously and can ensure the investments are suitable and meet your financial objectives and needs, and offer advice on consolidation of same with a focussed investment strategy tailored to meet your specific objectives.

Other considerations for reducing outgoings

You may have existing outgoings that can be temporarily reduced or paused to help your financial situation. These might include the following items, but other outgoings may also apply to your circumstances and are worth considering:

- Mortgage or credit card debt holidays

- Agreed deferral in rental payment

A long heritage of making a meaningful difference for our clients

Established more than 250 years ago, we are one of Ireland’s leading Wealth Managers. Our clients include a wide crosssection of senior managers, associates and partners.

Our aim is to make life easier for busy professionals, and our focus is on providing quality advice so that you can make the right choices.

Contact us

Get in touch

If you are a partner or other professional and would welcome clarity on your future finances please get in touch with us.

T: 01 280 0080

E: info@brewin.ie

Warning: The value of your investment may go down as well as up.

Warning: Past performance is not a reliable guide to future performance.

Warning: You may lose some or all of the money you invest.

Warning: Your investment may be affected by changes in currency exchange rates.

Warning: Any income you get from this investment may go down as well as up.